The Art of Feeling Great: A Guide to the System

In today’s fast-paced world, it’s very easy to feel overloaded and stressed. Handling your mental and physical well-getting is important for total pleasure and productiveness. That’s where Feel Great System comes in. This impressive approach mixes a variety of tactics and practices to aid folks acquire a express of balance and fulfillment. Here’s all that […]

Decking Boards: The Secret to Outdoor Bliss

Modifying your outdoor living area right into a practical and appealing retreat can be simply accomplished by using decking boards. These impressive resources offer you a multitude of rewards that may lift the beauty and features of any exterior place. From creating seamless transitions to enhancing user friendliness, let’s discover the potential unlocked by deciding […]

Streamlined Messaging: Online SMS Reception Options for USA Residents

With the creation of the API process, there is not any depreciation of the permission. The device will give you services associated with the customization in the messages. It can provide the greatest assistance for that affirmation code on Android users. When you choose to choose the automatic online SMS verification, then there is the […]

Sustainable Logistics: Environmental Considerations in Freight Forwarding

Freight forwarding has a crucial position from the international logistics chain, in the role of the intermediary between shippers and carriers to guarantee easy travel of items across borders. Whether you’re a seasoned importer/exporter or possibly a newcomer to overseas business, learning the essentials of freight forwarding is essential for effective company functions. Here’s all […]

A Comprehensive Overview of Timber Decking Boards

As soon as you’ve mounted your Decking boards (terasová prkna), suitable maintenance is vital to ensure their longevity and conserve their elegance. No matter if you possess wooden, composite, Pvc material, or aluminium decking, here are some ideas and tricks to ensure they are in good shape. Normal Cleaning: Frequently nice and clean your decking […]

Walking on Sunshine: Brightening Spaces with Wooden Floors

Wooden floor (drevená podlaha) have for ages been a trademark of land residences, exuding warmth, persona, as well as a incredible allure that resonates with nature. In traditional configurations, exactly where straightforwardness and validity reign supreme, nothing at all quite fits the allure of your well-put on wooden floor. Embracing wooden floors in land houses […]

Effortless Testosterone Ordering Online

Testosterone Alternative Therapy (TRT) is actually a treatment method for men who don’t generate sufficient quantities of testosterone. TRT is often prescribed by medical doctors to help you with reduced libido, exhaustion, muscle tissue lack of strength, despression symptoms, and other signs linked to reduced testosterone degrees. Using the technological advancements of the past several […]

HGH Peptides: A Breakthrough in Fitness Science

Reduced male growth hormone ranges will have a substantial affect on a man’s quality of life. As men grow older, their male growth hormone levels naturally decrease, that may trigger symptoms like lowered sex drive, erection dysfunction, low energy, depression, and an increase in weight. The good news is, male growth hormone alternative treatment method […]

Restaurant Deep Cleaning: Florida’s Best

Running a effective restaurant requires hard work, determination, and attention to fine detail. One of the more critical elements of maintaining your establishment thriving would be to conserve a clean and healthful atmosphere. Furthermore it make your buyers feel welcome and risk-free, but it additionally assists deep cleaning Florida improve efficiency and morale amongst your […]

Tummy Tucks and Red Carpet Moments: Glamour in Miami

One of the most common areas for concern in terms of body image is the abdomen. Many people, particularly women, struggle with loose skin or a protruding belly, especially after pregnancy or significant weight loss. While a healthy diet and exercise can make a difference, they may not be enough to achieve the ideal abdomen […]

Get the best from Your IPTV Monthly subscription By Using These Tips

IPTV, or On-line Protocol Television, has developed in a well-liked option to conventional cable tv and satellite Television set set up. With IPTV, you may get Tv set set up stations and courses on-line, offering you more control over the things you view and when you discover it. Although with the amount of IPTV professional […]

Game On: Embrace Cosmocheats

Would you like to the video gaming capabilities and reach new height in your favored games? Are you feeling like you’re stuck and incapable of development? If so, you’re in the perfect place. In this posting, we’ll be revealing some skilled guidelines that will help you release your video games probable and expert your best […]

Relax Your Muscle Mass right after a Stress filled Day time with Nuru Massage in London

London is regarded as a busy area loaded with electricity and pleasure. With a variety of steps to evaluate, locations to discover and spots to learn, it is in reality no genuine big surprise that London is really a favored holiday spot of folks from around the globe. Nevertheless, amid the vivid region, it is […]

An Intensive Guide to Getting CBD Items On the web

CBD, or cannabidiol, is definitely a naturally sourced ingredient within the hemp plant. It has been turning into preferred lately because of its a number of health benefits. Notably, CBD has been shown to lessen soreness and irritation, improve sleeping top quality and temperament, and in many cases aid in anxiousness and main major depression. […]

Picking the right Tantric Massage Supplier for the Quality Assistance in London

Every individual needs a soothing bust through the each day stress of lifestyle. Presenting its distinctive make contact with, the skill of tantra energizes a captivating feeling of calmness and mindfulness that is likely to awaken all of your recent sensory faculties. When you pay a visit to Tantric Massage London, you simply will not […]

Will Be The Auto Slot machine games Reputable To Experience?

Online slots are digital brethren in the standard slots that can be obtained from most casino houses. Further components such as fantastic visuals and spread icons, dynamic benefit rounds, a whole bunch more are found through online types of these popular video games. They already have Baccarat website, direct website (เว็บบาคาร่าเว็บตรง) of their own. The […]

What Elements Should be thought about When looking for Skip Hire Prices?

If you’re seeking to save cash within your after that skip hire, then you’ve appear to the proper area. On this site at [set company company], we have now been delighted to give the least expensive skip hire prices from the metropolis. No matter if you’re seeking a tiny 2-garden skip or perhaps sizeable 40-garden […]

The bright white tag facebook adsare a fundamental source of information for all those companies

Satisfy these days a white label facebook ads manager which has excellent instruments. So that you can create your advertising and know where they are put in blood circulation. To be able to monitor promotions concerning the advertising and marketing purpose appropriately You will quickly get this type of Facebook or myspace advert assistance in […]

Grow Your Following Instantly with Buy Instagram Likes

In age of social websites, it’s no key that looks matter—especially in relation to Instagram. With over one particular billion month-to-month users, the foundation has changed into a veritable who’s who of influencers, celebrities, and each day individuals sharing their day-to-day lives with all the world. And while some people are brought into this world […]

Make Your Voice Heard with White Label Facebook Ads

Increasingly more companies are recognizing the power of utilizing white label Facebook ads to attain their target market. White label Facebook ads enable companies to stand above their opponents, customize the appear and feel of the ad strategies, and make the most bang for his or her buck in terms of social media marketing. Let’s […]

Best Diet Pill Ranking – Discover the Best Weight Loss Supplements To Try in 2023

Introduction: If you’re trying to find the best diet pills that will help you get to your weight loss goals, is now the perfect time to start off researching. With the new 12 months right around the corner, there are plenty of appealing supplements out there which will help you drop those excess weight. Within […]

Alpilean or Alpine Ice Hack Reviews – Is This Supplement Worth Buying?

Introduction: Should you be looking to get rid of body fat, you may have heard of the Alpilean or Alpine Ice Hack. It’s a treatment program in line with the idea that by ingesting cold water at tactical factors throughout the day, you are able to boost your metabolic process and shed more extra fat. […]

The Benefits of Purchasing Trump Memorabilia Cards

As the 2024 Presidential election campaign heats up, many people are looking for ways to show their support for President Donald Trump’s re-election. One popular way to do this is by purchasing Trump memorabilia cards. These cards are certified by the Trump campaign and can be a great addition to any collector’s memorabilia collection. This […]

Learn How to Maximize Your Results from Taking the Best testosterone boosters for Maximum Power and Strength

Launch: Male growth hormone boosters have become well-liked by gentlemen that would like to develop muscle mass and improve their masculine growth hormones diplomas. Because of so many available choices, it can be overwhelming as a way to learn what one specific fits your needs. That’s why we’ve created the next info about where to […]

Visit The Best Massage Center Now

Swedish massage is actually a therapies that is very popular in the United States. This massage’s primary objective is definitely the uppermost covering of muscles, by which it can help in relieving muscle tissue pressure. The principle benefit from Bucheon massage (부천 마사지) is to help you relax. For those who have soreness, pressure, or […]

Porsche Services for All Models in Connecticut

Introduction: For all those in Connecticut who need Porsche Service New York, take a look at your local accredited experts. Whether you’re the first-time Porsche manager or possibly a veteran from the streets, Porsche-certified specialists are fully skilled and able to help to keep your car working at its top efficiency. Let us get a […]

If you want your company to grow, increase its benefits and increase its income, count on the advice of Dr. John Manzella

The four most important elements to choosing a good advisor like Dr. John Manzella are price, quality of service, adaptability, and trust. Regarding the price, it must be adjusted to our possibilities, but also market circumstances. On the other hand, it must be as transparent as possible; the billable concepts must be as clear as […]

Making use of cbd edibles to alleviate soreness

The planet helps to maintain altering as new breakthroughs take into account centre level. It is actually exciting to remember the discussion on if you should use cbd or not still rages on as all those around the wellness industry take pleasure in the reality that all-natural merchandise can certainly be used for healthcare and […]

The Pros and Cons of Numbing Cream: What to Know Before You Use It

Whether you’re a first-time tattooer or perhaps a veteran pro, no person loves the anguish of obtaining inked. Luckily, numbing products may help consider the benefit away, creating your tattooing expertise far more pleasurable. But with so many TKTX numbing cream merchandise available on the market, how do you know which one is right for […]

Approaches to enjoy the Swedish massage

Are you a sportsperson and you need to stay healthy? When it is what you will be worried about, then contemplating Massage therapies is definitely a great plan. Should you really get information from the finest sportspersons from your personal-management, you will find that they may be generating a great investment their period with this […]

Professional Packing Material Provider for Businesses and Consumers

Choosing the best plastic mailing bags for the organization can be a challenge. You desire to make certain that you are getting top quality goods whilst maintaining charges low. Thankfully, there are actually custom plastic-type mailing bags available offering financial savings, durability, and high quality high quality. Let us investigate why is these mailers so […]

The Most Effective Skilled Attorneys-Online Are In this article

If you want in to the future into business functionality you will need a phase enjoying ground that may put together the way prior to you for company achievement. It is crucial speak to an organization attorney that can provide you with all that you required to have an edge on contender producers which were […]

Let Your Truck Do the Work for You with an Enclosed Trailer

For company owners who need to haul a lot of materials from a spot to another, an enclosed trailers delivers lots of benefits. No matter if you’re transporting equipment, tools, or any other materials, getting an 8.5 x 28 enclosed trailer will make your career much simpler. Let’s check out just a couple positive aspects […]

Will not cease carrying out a tantric massage London. You will need to come back

There may be numerous varieties of outstanding tantric agencies, offering the very best massages performed by professional little girls. After coming into this situation, you are going to find yourself captivated because it has got the most great and sensuous girls, with excellent school and gurus. Any demanding client can key over these organizations and […]

Understand the many benefits of using Stylus Pens for Touch Screens

The Stylus Pens for Touch Screens is actually a state-of-the-create pencil which can be used on capacitive contact exhibit screens, offering several beneficial aspects and accuracy and precision when making. Capacitive effect screens make use of an electrostatic willpower that registers the be in touch with when a conductor distorts it. These pencils perform the […]

Suggestions to discover the proper Music download service

Are you going to just like your audio at nighttime? How would you like taking part in your chosen tunes when you’re planning every day? Should you resolved yes to both of the aforementioned questions, then you probably know someone that does. About 78Percent of Americans track into songs whilst they’re working in the evening, […]

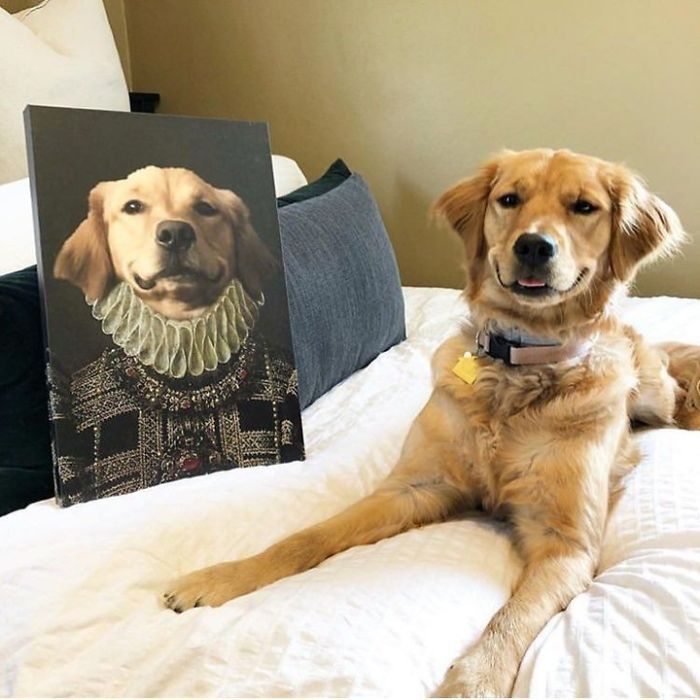

Know far more information about platforms that provide you with the possibility of creating customized pet portraits

Whether the interest in art work or is simply for piece of art allures you. You should try these tactics with all the platforms you can find online. Typically, you start out should you not possess expertise but a great deal of interest in paint your pet art. Would you start to look of these […]

Secret Tantric, the best place to enjoy a London tantric massage

Learn information on tantric massage at Secret Tantric, a good place to take pleasure from a specialist and premium quality London tantric massage to have the very best discomfort of delight. Using this assistance, all customers get to an increased amount of satisfaction, which enables knowing the complete possible erotic massage of the sex electricity. […]

How To Achieve A Good Business Reputation

Francis Santa owns many businesses, and one of the businesses he owns is the Image Lift, which aims to help companies create and build a good business reputation. Business reputation is very important to any business, and managing it right is necessary. Is it hard to achieve a good business reputation? Actually, it is, it […]

What are the advantages of getting a personalised portrait of your pet?

You are looking for tips concerning how to improve the appearance of your pet paintings while minimizing their charges. I want to provide you with some words of advice. You don’t have to lookup any further than iced pet paintings in order to uncover the suitable present for an individual. Are you finding that being […]

What is the average turnaround time for a painting service?

Within the sentences that stick to, we shall talk about the benefits of making use of this kind of services, the best way to establish the support that may be best option in your requirements, plus some concepts for identifying the best assistance. Furthermore, we shall explore the benefits of using these kinds of service.When […]

Why do individuals hunt for steroids shop canada?

In this article, we will notice what folks look out for in buy canadian steroids just before we proceed to the principal subject matter we should comprehend the fundamental Q&A What are anabolic steroids: steroids go shopping canada? Anabolic steroids are man-made (man-made) different versions of testosterone. Androgenic hormone or testosterone may be the principal […]

Csgo accounts and keeping your account safe from banning

CS: GO profiles Lately, we have seen a growing demand for CS: GO accounts. This is due to the excitement in the video game and also the large number of players associated with taking part in it. There are many different kinds of CS: GO profiles, each and every using its benefits and drawbacks. Before […]

Facts about the use of Duvet cover (Påslakan)

You will be not the only one if you need your bed room to become a queen’s area. It only shows that you simply love deluxe and also you cherish your sleep. Buying of Duvet cover (Påslakan) is easy and you could place an order for starters at any time. You don’t require any concerns […]

Enjoy the best Gangnam Massage (강남마사지)

You may have ever went to a Day spa and managed to do a massage. These massages accomplish a restoring operate that offers well-getting and fulfillment to anyone who is provided with them. In Korea, you may discover a Gangnam One Shop (강남1인샵) where one can be provided with the best professionals in the region, […]

What are the advantages of utilising a music download service online?

There are numerous factors why you ought to sign up for up for the compensated online music acquire services in contrast to accessing MP3s totally free. Figure out why it seems sensible to subscribe to an online music download service by studying on. This publish will assist you to decide on which support is perfect […]

4 Factors You Should Consider When Visiting A Breast Implant Center

You’ve made the decision to get breast implants Miami. Congratulations! This is an exciting time, but it’s also a time when you need to do your research to ensure you’re making the best decisions for your body and your health. Not all breast implant centers are created equal, so here are four factors you should […]

Track down Tranquility With Piece of art By Figures Art

It really is fascinating the number of choices which might be located on the net when it comes to performing a certain method. Technological innovation and a variety of method have revised and let amazing things to be done both manually and electronically, additionally it actually is one particular essential thing that could come to […]

Know More About Numbing Cream For Tattoos Boots

The be sorry for of a awful body art Be sorry for of your poor tat is a thing you should deal with for the rest of your lifestyle as removing a tattoo ain’t so simple. It’s not something that you can simply hide or deal with-up, and it’s not one thing you may ignore. […]

How you can install so player on firestick

One thing that can be done to savor the best holiday experience is actually by buying and observing movies on-line. With so player firestick, you may enjoy a limitless streaming encounter from the comfort and ease area and without undergoing pressure. Even so, it is important to inform you that you need to take some […]

Firm your muscles with a Swedish (스웨디시) massage

Learn how to strengthen your immunity mechanism with the exceptional Swedish (스웨디시) massage that can be done through a 1 person shop (1인샵). This type of massage is pretty typical these days you need to understand a professor of sports medication developed this procedure as being an vital strategy to repair your body. This massage […]

Make money for the team (tjänapengar till laget) easily and buy everything your team needs

Make money for the team (tjänapengar till laget) and acquire almost everything your staff needs. It will be easy to boost dollars by offering great-good quality items that will earn you SEK 60 for each and every package marketed rapidly. It becomes an possibility never to be missed if you would like battle for that […]

5 Easy Steps for Getting Started with Online Sports Betting

Together with the popularity of on-line sports playing growing exponentially, it’s no real surprise that a lot more people are looking to be in about the motion. But, if you’re a novice to on-line sporting activities gambling, don’t worry – it’s relatively easy to get started. In the following paragraphs, we’ll walk you through a […]

Enterprise Financial loans and Lines of Credit rating: What You Need to Know

What exactly is a organization loan? A line of credit? What one is better for your personal company’s requires? They are all concerns we will response within this article. We shall go over the real difference between these 2 kinds of loans, the way to get approved for either a single and what you should […]

The Beginner’s Guide to Picking the Perfect Slot Machine

When it comes to wagering, slots are one of the most widely used alternatives. Right here, this is due to they are super easy to enjoy and can be extremely lucrative once you know choosing the correct types. This blog submit gives you advice on choosing the most effective slots for you personally. So no […]

Make sure you check out the information regarding wholesale clothing

Precisely what is your top priority once you buy the garments? Many people go along with the high quality. It matters a lot to them. But concurrently, they want amazing options within the garments. On this page you receive the perfect option for this difficulty. The wholesale clothing has every thing you would like. It […]

What is the worth of getting numbing cream?

Who would desire to deal with the discomfort while getting the tattoo when they have the straightforward and simple solution? There are lots of tattoo numbing cream offered out in the market with assorted apps. These things use a ridiculous effect and are quite extraordinary to work with while getting the tattoo. On this page […]

Learn what the new virtual option of the best football betting web sites is all about

The best football betting internet sites are tailored to meet your requirements to produce you productivity. You will discover the most crucial physical activities by diving into its large repertoire of opportunities. This reality can make it less complicated to get your best squads, offering you direct availability occasion. The best on the web on […]

Things you can do on safari trips in Dubai

It is easy to have some fun in Dubai. The current town is full of attractions that will fulfill all tastes. However, when in Dubai, never forget to quit by among its hidden gemstones, the wilderness. Taking a journey to Dubai can add a different feel to your vacation. Things to do over a safari […]

Finest Elements To Take Into Consideration About Pok Deng

card game also popularly named Pokdeng (ป๊อกเด้ง). This is basically the kind of Pokdeng famous in Thailand. This card process has fantastic experiencing patterns, plus the identical can also enable two to 17 players, like the seller. Different info to understand about Pok Deng With regards to Pok Deng, around three main factors establish the […]

Play Online Slots for Maximum Winning Potential: Baccarat

Online slots are a ton of fun, and there are several methods which you can use to boost your odds of winning. In this blog post, we will go over one such technique: playing baccarat. Baccarat is a preferred casino activity that is enjoyed with cards. It can be straightforward to understand but can be […]

Browse The Steps To Experience Online Casino Card Games

You might may have learned, online casino card games are preferred on the internet internet casino game titles about the website. The regularly actively playing from your charge card video game is between 2-4 sportsmen. In case you are regularly enjoying ป๊อกเด้ง credit card game titles the 1st time, you will want o look at […]

The Advantages of Online Slot Game Strategies

There are numerous advantages to taking part in internet casinos. You are able to play online games whenever you want and from any spot, and you will win actual money the process. You will find no geographic constraints in relation to this particular gambling. Your personal computer or mobile phone, with an connection to the […]

Go to The Best Online Slots Sites

For many who wish to participate in on line casino online games but are unwilling to put their cash at risk, there may be always the option for taking part in casino games on the internet. In lots of ways, the games here are exactly like those you would probably see in a regular traditional […]

Advantages of using the ball price

Exactly how much does the ball price? Anybody who appreciates dealing with the ball can make use of the personal associate tool to aid us in examining probably the most tough difficulties. People who obey the ball desk and the ball price on our site will be familiar with the present ball price. Ours is […]

Ball price flow (ราคาบอลไหล) reveals different versions from the price from the ball

Football figures alter very commonly and rely on several technical, numerical and perhaps personal factors, something by any means which transpires with athletes and also other considerable stars relevant to this hostile process can transform the percentages for any game’s success. Soccer supporters assortment in the hundreds of thousands all over the world, as do […]

It has the White label seo services for agencies to offer to your clients within the agency elevation website.

If you Will Need the Finest White label Seo services for bureaus, seek the services of the pros from the bureau elevation website. Upon inputting your site, you may have all the information you need so that you are calm while claiming the white label facebook ads results of all your clients. Safely and securely, […]

Enjoy the best Safari Dubai with this agency

Its magnificent hotels, Guinness records, and exotic surroundings are making Dubai a vacation spot that interests thousands of travelers every year. Should you be considering visiting this city in the United Arab Emirates, you may also dare execute a desert safari in dubai and stay some other encounter. A lot of people think about Dubai […]

Everything About The SMM Panel

Social media has developed into a basic need for almost any business that wishes to increase the give back on its advertising and marketing assets. With Twitter and facebook ruling the industry reveal for most of us, it’s easy to understand why social media is indeed popular. The problem is that numerous online marketers are […]

Swedish Massage: Know what good it offers

Swedish massage is amongst the most in-demand and required restorative massage methods. It is a delicate therapeutic massage which utilizes long strokes, motions, vibration that assists in comforting and energizing you. Swedish massage is the foundation for other kinds of European massage, including athletics massage therapy, strong muscle restorative massage, and aromatherapy therapeutic massage. There […]

Massage therapy : All that when you need to have one

There are lots of instances when massage treatment might be valuable. This blog article will discuss some different circumstances when you might need to find out a massage therapist. There are many reasons the reasons you might take advantage of a massage, from severe headaches to nervousness. Please read on for additional information! 1. You […]

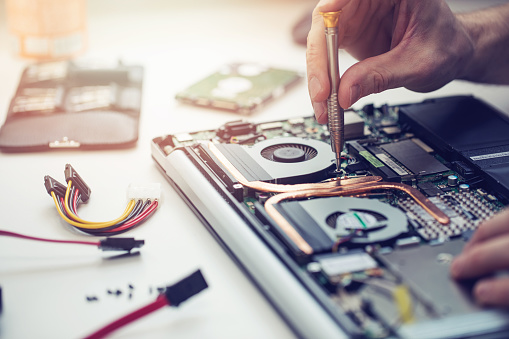

What to look for when choosing a new computer repairing company

Pcs and laptop computers are becoming a crucial component of our life. Modern technology has turned into a every day and crucial element of daily life, and with the advancements, all sorts of things has shifted to on the web implies. Also, the covid pandemic that struck the entire world created the internet and the […]

What to expect while getting tattooed?

Tats are a form of skin area amendment that requires using color and fine needles, as well as colouring brokers. Tattooing is the method of applying for a body art. They can be tattooist (타투이스트) momentary or long lasting. The background of tattoo design being an craft 미니타투(Permanent tattoos)are a type of historical process which […]

The Best Way To Succeed At Slot Devices: Tips And Tricks

If you are searching for methods for online superslot video game titles, your search is over. This website write-up will straight you with the top recommendations. You could possibly even identify your greatest website! Let’s Have A Look At The Strategies That Could Assist You To Succeed Huge: Preliminary, Use A Steady And Stable Level: […]

Why Trust &Credibility Matter In Ecommerce

If you’re operating an internet retail store, you realize the value of search engine optimization (SEO). SEO might help your internet site rank higher in search results pages, which implies more people will spot your site and potentially buy something. In this particular article, we’ll go over how SEO will benefit your ecommerce enterprise! A […]

Obtain through a special website the oil CBD oil for dogs

When applying the essential oil Best cbd oil for dogs, it is far better that you simply keep in mind the actual way it reacts on the item. Some effects are immediate, although some consider a few days. If you are using this kind of essential oil with your pet to reduce nervousness, you will […]

Essential information that you need to learn about weight lowering products

Introduction If you have been battling to shed weight for a long time, the easiest method to accomplish what you are looking for is by using weight reduction goods. There are various kinds of weight loss products on the market however, not all are safe. Before trying to make use of the body weight reduction […]

ONLINE GAMBLING SLOT95 WITH LOCAL BANKS FOR TRANSACTIONS

Gambling, a word stands for cheating for most of the people. The inner meaning is far away from what people usually think. The gambling in many cases helps one earn money. There are even people who believe that it is the only source for them. Online gambling games are to be played with caution. As […]

Most common blunders to avoid on online gambling

This really is that athletics wagering is not merely a fun-filled factor, but it additionally offers you an opportunity to generate excellent amount of cash! You could do only when you find yourself actively playing at the correct foundation and also the right approach. Most on-line bettors are not aware of the mistakes which first-timers […]

Downloadlagu321: Now you can download mp3 from this website

In an era when companies are even more interested in evaluating the productivity of their workforce, trying to find ways to improve performance in the workplace becomes even more relevant. This has become a priority for any business leader. While it is easy to think of improving productivity with process optimization or adding additional staff, […]

File your taxes to get the HST rebate in Ontario

Understand the simplest way to document your fees so that you can get the HST rebate in Ontario. Basically go to the HTS Refund Center website to get the pros who may help you increase your hst rebate ontario new home HST reimburse. Receive the best information and expert consultancy to determine when you are […]

Major Tips for Buying a 360 photo booth

Are you in the market for a 360 photo booth? If you have, there are a few what exactly you need to bear in mind. This blog submit will talk about strategies for investing in a buy a 360 photo booth. This will aid ensure that you make a knowledgeable obtain and obtain the best […]

The Different Types of Upper body ergometers: What Works Best for You?

In terms of upper body ergometer, there are many different types to select from. Each one has its advantages and drawbacks, how can you know which one fits your needs? In this post, we are going to discuss three of the most frequent forms of Upper body ergometers – recumbent motorbikes, upright cycles, and ellipticals. […]

Computer repair Limerick offers you a unique service in computer repairs

it support limerick is a specialized and efficient support that allows you to maintenance and keep your personal computer in good shape. They provide a whole services with basic safety and quality standards to ensure people are completely pleased with the very last outcome. They have a lot more huge discounts compared to competition for […]

What to Expect on a Desert Safari in Dubai

You can decide on a number of Dubai desert safari possibilities, for example the preferred morning hours safari, the relaxing mid-day desert visit, as well as the intimate evening hours wasteland adventure. A early morning safari commences with the crack of daybreak and finishes with the stroke of dusk. An evening excursion typically commences at […]

Being in Online (แทงบอลออนไลน์) casinos was never so good.

The love for the game online gambling website (เว็บพนันออนไลน์) is present, who would unlike to have at hand a program to meet all the needs of your dedicated person? It is something that is expected, which is craved. There are millions of pages that are watched daily, but not almost all manage to fulfill the […]

Learn the top reasons why should you play gambling games online

Lockdowns as a result of Covid has contributed to several changes around the world, and one of the greatest modifications that people see has resulted in the move standard betting industry for the online settings of taking part in a similar games. Prior to Covid, there was clearly lesser targeted traffic on these systems, even […]

PKV Games are some of the fan-favored options

The best online online on line casino online games along with the very best choices to acquire bets are available at pkv games. This website comes with an impressive method that treatments wagers quickly while experiencing a lot of fun with any Poker On-line. The plethora of video gaming and the ease of choosing the […]

What basic things you should know about MP3 files?

You might already be familiar about the mp3 format as people have been downloading it from sites like metrolagu mp3 download for a long time and experiencing the benefits. But it is also essential for you to know some fundamentals as well. Ask yourself: why does the mp3 file size deviate so much? You can […]

Use the commercial loan calculator to find out your loan amount

Organizations have configured an ideal device to get credit without expense or financial debt: commercial credit rating. Fortunately that it must be now easier for anyone and banking companies to calculate the entire amount borrowed, thanks to the commercial loan calculator. With this particular, they are able to buy the merchandise that they need without […]

Get to know the guitar chords (chord kuncigitar) through the right place

If you want to learn to play guitar, you should know the basic chords (chord dasar) through a recommended website. This place offers a lot of free chords. It offers a great auto-scroll function that ensures that the page of chords scrolls down and adjusts the speed. Almost all the chords on this platform have […]

Quality Gaming Services Available Today to Earn Profit

Having access to wide selection of games was never this easy as it is today because of various online platforms of gambling that are not only secure but provide you services like secure transaction methods and a lot of games. There are also different gaming providers within the platform that provide you different services of […]

Enjoy real free competitions in one place

Are you currently a fan of Competitions? You need to gain access to a favorite and reliable internet site in the UK. This way, you are going to take pleasure in safe and 100% actual gives that can make you reduce costs and generate cash. The best internet site in the united states has a […]

Ensure your safety when playing online thanks to eating verification (먹튀검증)

At the moment, you can get specialised confirmation sites that provide you with a top quality and safe Ingesting verification site (먹튀검증사이트). It is recommended to go with a safe and liable platform generally to get the best in the toto world. For those who have these sorts of web sites for your use, you […]

This Betting Site Will Help Deliver the Big Winnings

The internet casino can be a company market where you can get all that you require to get what you should make existence beneficial. You should state right here that your accomplishment is dependent upon your enter and also the method in the playing funnel you have preferred one of the possibilities on-line. In case […]

Beneficial reasons to freeze your egg for future pregnancy

Folks may go with regard to their professions and invest too much time and energy behind it. There may be nothing wrong in it but often times they overdo their tasks and in some cases time disappears and later these completed individuals often regret not implementing swift selections relating to acquiring their future pregnancies. Sure, […]

Paint by numbers custom is very effective for people’s health

Paint by numbers for Adults is a method that allows you to isolate a graphic in a different way. Additionally, it ought to be taken into consideration that every condition is given a particular number linked to a definite color. Every single design is decorated and formed in a comprehensive personalized paint by number painting. […]

Sociable-Boost24 is the best site to buy followers (Follower kaufen)

Having a huge number of followers on Instagram lets you boost your status as well as the visibility of your own account. Their variety and connections also can expose your acceptance and Buy Likes (Likes Kaufen) reputation. So when you decide to Buy Instagram followers (Instagram Follower kaufen), you almost immediately get plenty and a […]

Call on the tantric London service that only Secret Tantric can offer

Tantric massage provides many benefits it is a treatment method which not only tries to energize intimate feelings. But it additionally helps to know our personal entire body and obtain a better experience of London tantric massage relaxation. As a therapies, it really is good for enhancing emotional and physical well-getting, assisting to remove anxiety […]

The essence of gifting peoplePersonalized Jewelry today

Gifts are necessary a part of partnerships specially when celebrating anniversaries, birthday celebrations, wedding parties and other events across the calendar year. When selecting a gift to buy, you should make a decision on the proper present or else you could just overlook the impression you wished to generate. Fortunate for yourself there are several […]

Medical Advantages – Buy CBD oil

In this fresh day as well as time, many are moving to the contemplations of a superior general determine and complexion. When you eat nourishment from the cafes that includes oily and also salty fixings, it really is believed to be awful for you and your prosperity. Some of them are not dreadful. When you […]

Buy Cbd Oil – Reliable Supply

A great many people don’t have enough from the correct fat in their eating regimen Fundamental Fatty Acids EFA’s are required within your eating program, in light of the fact your body is unequipped for delivering these. As 95% of men and women are inadequate in these outstanding fats, their particular need in your eating […]

Why Do You Need to Hire a Translation Company?

For a company to expand and be successful over a around the world schedule, it needs a highly-coordinated web marketing strategy which will help them distribute its concept to new customers and help them create vital organization leads. With the help of an effective and high-top quality promo marketing campaign, a company may live and […]

Receive a Christmas food hampers gift at work full of products

Locate a wonderful collection of premium items for all palates and choices with the different Christmas Hampers made available from Hand-made Holiday Co. These gift baskets are a part of the beautiful traditions that describes Xmas at this point, individuals are living instances of maximum contentment like evening meal with friends and family that do […]

Find out how easy it is to locate a supplier of cbd oil uk

If you locate yourself in the depressive disorders on account of function or troubles in the home, try to restore having a massage therapy. But you should not select a regular massage therapy, but one with cbd oil uk. CBD gives numerous advantages on the emotional and physical level once you place it in touch […]

A guide for choosing a business loan

Introduction There are several kinds of business loan consolidationout there but not all of them might be a great in shape for yourself. When choosing a company personal loan, many people make your mistake of centering on the fascination only. In addition to the attention, various other factors should be regarded as in choosing an […]

The comprehensive information on the consumption of exipure strong supplement

The exipure diet is taking the planet by surprise recently. Simply because it is actually a healthier, sustainable weight reduction answer which can be done in your own home without a lot of issues. As with all item, proper dosing is key to success. Here are a few guidelines when planning on taking exipure powerful […]

How to Make the Most of Your Time in Business

Whenever you go on the web looking for the ideal keeping track of device you could believe in to present the best that can deliver effective deal with of next by 2nd surgical procedures in your series, it is actually required to companion by using a specialized medical mobile app. When you are uncertain about […]

Buy The Best Mattresses On Dormi

Nothing is much better over a plush mattress along with a good night’s sleep at night. At Domi, your comfort is our most important priority, and that we supply a wide array of Master and Queen bed mattresses suitable for you. Our prime-high quality Innerspring mattress is a great mixture of memory foam and budget […]

Don’t waste the opportunity to hire the best translation companies

Having a organization or manufacturer is not really simple, a lot less when it comes to broadening on the potential audience. Receiving a larger sized customers could be very laborious, particularly when considering people with another terminology. In this instance, it is required to acquire translation services that make connection between both sides possible. Many […]

The key elements to play are in the joker slot

There are many approaches to be derailed and enjoy oneself, but games have become the most preferred collection of numerous Online users. Internet sites like joker Slot machines have revealed that they have the important thing aspects to be very popular with on-line on line casino game titles fans. This video games system provides followers […]

What is FlokiInu?

Within the Bitcoin currencies, among the numerous canine meme foreign currencies is definitely the FlokiInu, much like ShibaInu and Dogecoin. This coin was influenced through the dog in the creator and CEO of Tesla, Elon Musk. It asserts to become community-owned and operated crypto program and contains also collaborated with million backyard activity, the undertaking […]

Explore The Tips For Playing At Online Slot Machines

Are you searching for ideas to engage in on the web joker123 online games? If so, then there is limitless information accessible for the actively playing of on-line slot games. You need to be a part of the proper site to understand about the tips to obtain more incentives at on-line slot internet sites. It […]

Know More About Condos For Rent Toronto

Considering that Increased toronto place is famous due to its travellers due to desired site visitor areas, you are able to certainly look for several kinds of condo properties in this article. There are many versions offered through the beachside, but those might amount to get pretty expensive. The place does really make a difference, […]

What are the many benefits of using amazon FBA?

Amazon is the biggest e-commerce platform in the world and there are a lot of people associated with this mega online retailer. If you are also interested in selling goods online and are thinking of taking a start from your website, you might be wrong this time because now the best way of selling products […]

How could an asset based loan be helpful for businesses?

Your small business may need a great deal of money at any minute for further continuing. Of all credit options out there, asset based financing might be beneficial. We will discuss the different benefits associated with this approach in brief. Reduced costs The main benefit of asset based financing is the decreased rates and payment […]

Can you repair the garage door yourself or need an expert?

One of the most beneficial items you can make the property is an auto door user. However you may try it for yourself just before applying these fundamental suggestions along with the unit’s specific referrals. A bidirectional motor unit techniques a wagon along one rail just on top of the entrance inside a traditional garage […]

Enjoy Casino Games by Joining Internet Casinos

With increasing popularity, online casinos have emerged as one of the most preferred modes of entertainment for people who love playing casino games. A great number of people are now becoming interested in playing online games as online casinos have become very popular amongst all age groups. One of the major reasons for its popularity […]

Video door intercom integrated with alarm systems

Clearly, in case you are as yet throughout the time invested composition your property, nothing helps to keep you from selecting the cabled option. It is the better excessive decision, however by adding cords straight into the establishment of your structure the current market worth may go up. Likewise, when opting to go the hard […]

Benefits of taking help of the cleaning companies

In the provide time, a lot of people desire to cleanup their home but don’t have much time to achieve this, which is actually a issue for these people. For that reason, a lot of people choose to accept aid of housekeeping company (societe de ménage) all all over the world. Exactly what are the […]

In this vape shop, you can find resistant and reconstructible atomizers

The vape shop consists of two basic components: on one side, battery, which is often recharged as many times as you want and alternatively, the atomizer, which is in charge of switching the liquefied into vapour, with scents, without or with smoking as well as with tobacco fragrance. In recent years, as everyone knows, there […]

24/7 Online Gaming Fun with MILAN69

In the fast-paced an entire world of online gaming , efficiency along with usage of real-time info tend to be crucial. Type in MILAN 69 , a sophisticated built-in online game representative developed to reinforce your current gaming practical experience throughout the clock. Featuring a effortless integration along with 24/7 variety, MILAN 69 is really […]

Understanding NFM Lending: A Comprehensive Guide to Home Financing Solutions

nfm lending is a prominent mortgage lender known for its extensive range of services and customer-centric approach. Founded in 2000, the company has grown rapidly, establishing a strong presence in the U.S. mortgage industry. Headquartered in Linthicum, Maryland, NFM Lending offers a variety of home loan products designed to cater to diverse borrower needs. The […]

The Complete Keever SEO Toolkit for Beginners

Inside today’ohydrates digital surroundings, acquiring a robust on line presence is essential for business enterprise success. And here , Keever SEO has play. Dedicated to search engine optimization (SEO), Keever SEO presents comprehensive services developed to boost a person’s website’azines visibility as well as in search motor results. At the core with Keever SEO strategy […]

Cost-Efficient Moving Tips for Relocating to Stockholm

Moving city Stockholm (Flyttstäd Stockholm, called the actual Venice of the Upper, is acknowledged for it is picturesque iss, old landmarks, and also brilliant neighborhoods. Whether or not you’actu a brand new kama’aina ( or maybe visitors studying the town, here’azines information on several of Stockholm’utes most notable areas as well as attractions. 1. Gamla […]

Best Jackson Skates for Ice Dance: Our Top Picks

jackson skates, a renowned identity inside roller skating community, is really a trusted product regarding amount skaters along with curler skaters alike. Recognized throughout 1968, this company has produced some sort of popularity due to the high-quality skates plus progressive patterns, serving skaters of most quantities, through newbies to be able to professionals. Past and […]

Why Totalsportek is the Go-To Platform for Sports Fans

Together with the advancement of sports streaming , enthusiasts are always in search of websites that offer the most beneficial taking a look at experience. Totalsportek has changed into a go-to destination for sports fanatics who need easy usage of preferred games. Regardless of whether you’re also a devoted soccer supporter or simply a die-hard […]

How to Find Reliable Free MMA Streams for Major Fight Nights

Are usually you an MMA fanatic trying to capture all the thrilling motion regarding UFC as well as Bellator occasions live? No matter whether you’regarding a proficient supporter or possibly a newcomer to be able to the experience, mma streams might be a game-changer. Along with the right tips and tricks, you are able to […]

A Comprehensive Guide to NFL Streaming Services

Release Usually are you an NFL fanatic attempting to elevate your streaming practical knowledge? You are in the right spot! If you’regarding your long-time supporter or perhaps a newcomer, the following site article will direct you by means of ways to increase the nfl streaming experience. Out of refining your internet connection to choosing the […]

The Best IPTV Services for Interactive Viewing Experiences

Within the rapidly developing an entire world of electronic digital amusement, IPTV (Internet Protocol Television) has got come about for a game-changer. The item makes it possible for people so that you can steady stream television system articles over the web instead of through traditional cord and also satellite methods. Fogged headlights you should know […]

Tips and Tricks for Searching Apartment Rentals Near Me

Searching for an apartment rental can be a daunting task, especially if you’re not sure where to start. Whether you’re new to the rental market or a seasoned renter looking for your next home, these tips and tricks will help you find the perfect apartment rental near me. 1. Define Your Priorities Before you start […]