Navigating MetaTrader 4: A User-Friendly Guide

metatrader 4 (MT4) is a powerful platform used by traders worldwide to access the financial markets. While it’s renowned for its user-friendly interface and basic trading functionalities, there’s a wealth of advanced strategies and techniques that can be employed to maximize its potential. In this article, we’ll delve into some of these advanced tactics, shedding light on how traders can leverage MT4 to enhance their trading endeavors.

One of the key features of MT4 is its flexible leverage options, allowing traders to adjust their leverage according to their risk appetite and trading style. This flexibility enables traders to manage their exposure effectively and optimize their capital utilization.

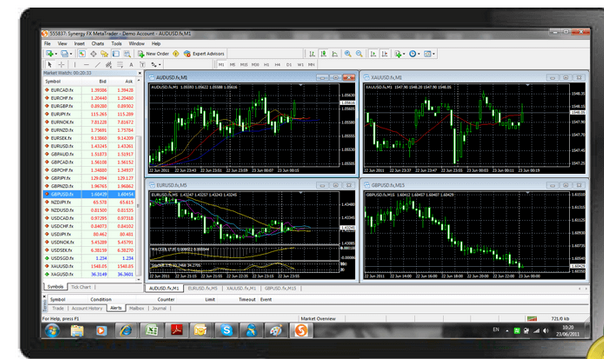

Advanced charting tools and technical indicators are indispensable for informed trading decisions. MT4 offers a plethora of built-in indicators as well as the ability to install custom indicators, empowering traders to conduct in-depth technical analysis and identify potential trading opportunities with precision.

Furthermore, MT4 supports automated trading through the use of Expert Advisors (EAs). These are algorithms that execute trades automatically based on pre-defined criteria, eliminating human emotion from the trading equation and enabling round-the-clock trading. Traders can either develop their own EAs or choose from a vast library of ready-made ones available online.

Risk management is paramount in trading, and MT4 provides several tools to help traders mitigate risks effectively. Stop-loss and take-profit orders can be set to automatically exit trades at predetermined price levels, protecting profits and limiting losses. Additionally, trailing stops can be employed to lock in profits as the trade moves in the desired direction, while still allowing for potential further gains.

Another advanced technique is backtesting, which involves testing trading strategies against historical market data to assess their viability and performance. MT4’s strategy tester feature allows traders to simulate trades in real-time, providing valuable insights into the efficacy of their strategies before risking real capital.

Moreover, MT4 facilitates multi-asset trading, enabling traders to diversify their portfolios across various financial instruments such as forex, commodities, indices, and cryptocurrencies. This versatility allows traders to capitalize on opportunities in different markets and adapt to changing market conditions.

In conclusion, MetaTrader 4 is not just a basic trading platform but a sophisticated tool equipped with advanced features and capabilities. By harnessing the power of flexible leverage, advanced charting tools, automated trading, risk management features, and multi-asset trading capabilities, traders can unlock the full potential of MT4 and take their trading to new heights. Whether you’re a novice trader or an experienced professional, MT4 offers a comprehensive suite of tools to support your trading endeavors and help you achieve your financial goals.